Tokenized Deposits

- Real-time multi-assets settlement platform that enables mint, burn and transfer of regulated liabilities over DLT

- Tokenized bank deposits (a bank account) for fintechs

- 1:1 reserve ratio via proof of reserves consensus mechanism

- Tokenized deposits OR riskless stablecoin bank account system

- Tax exempt interest payments

- Proof of reserves, immune to bank runs

- Transparent operations

- Non-custodial (i.e. your keys, your wallet)

- Programmatically immune to debanking practice

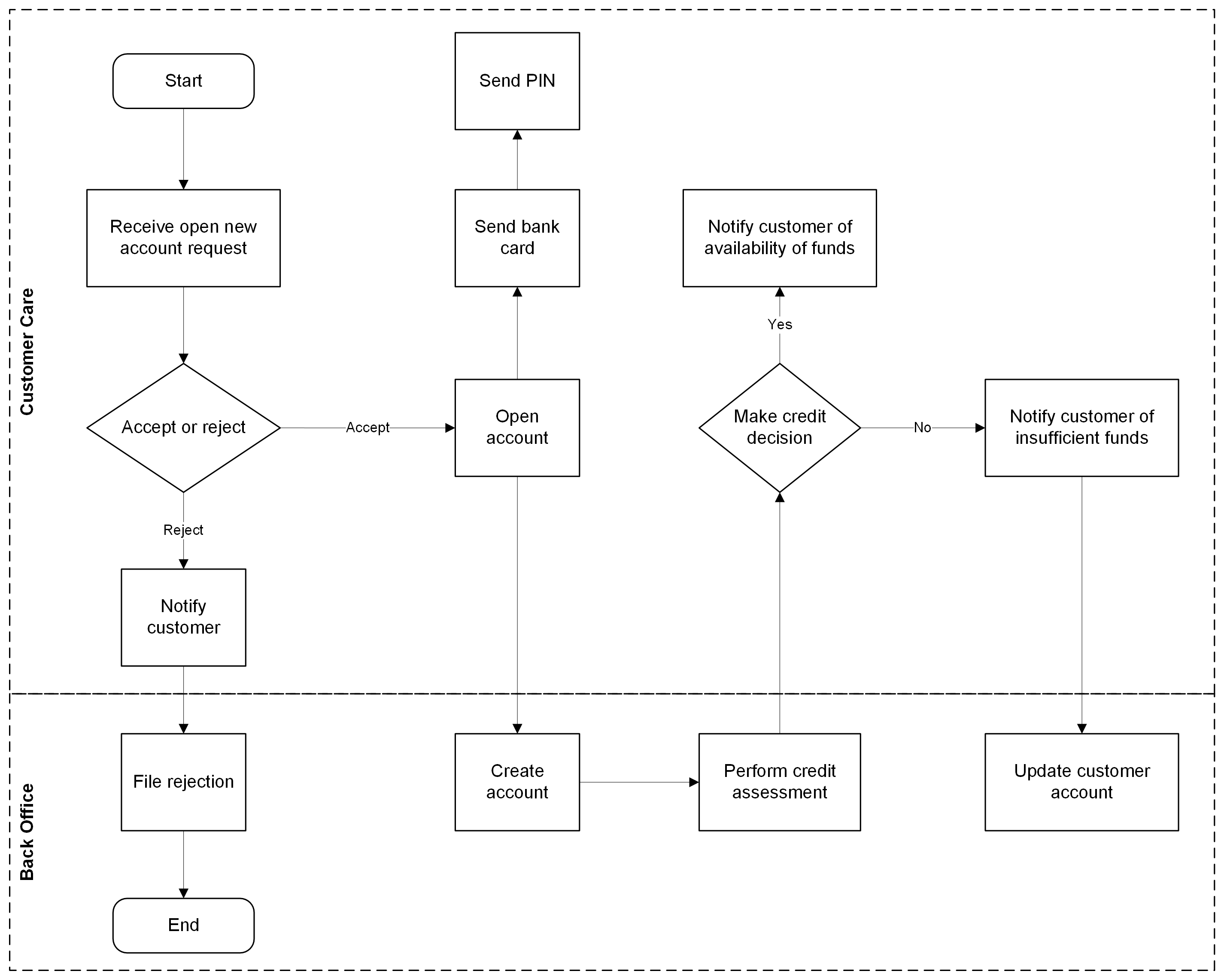

- 1. Request verification (standard KYC/AML checks)

- 2. Approve/reject based on crypto compliance

- 3. Create digital wallet instead of traditional account

- 4. Issue wallet credentials instead of physical card/PIN

- 5. Connect to stablecoin network

- 6. Fund wallet with selected stablecoin

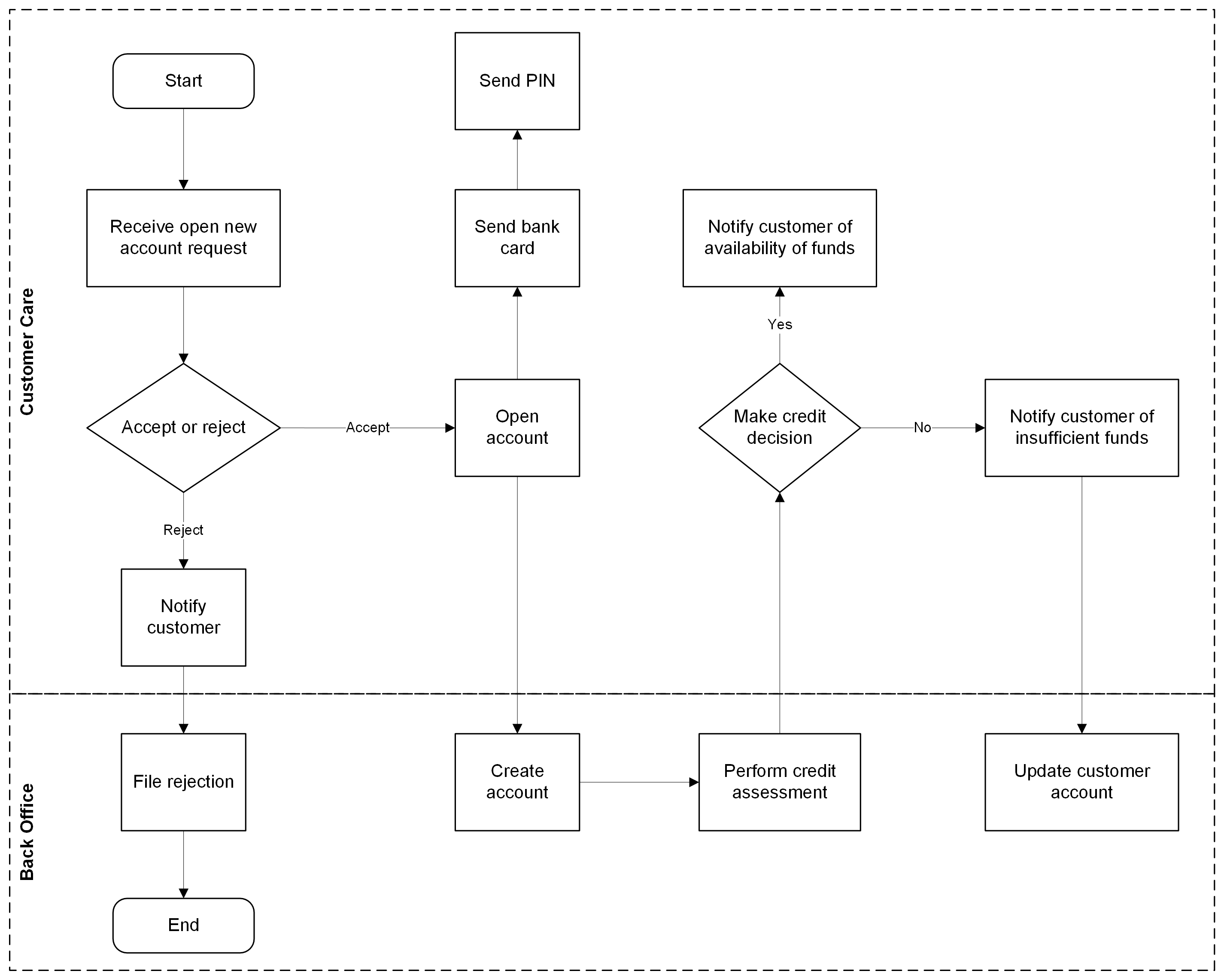

- 1. Customer deposits USD to bank custody account

- 2. Bank verifies funds settled

- 3. Smart contract mints equivalent USDX

- 4. USDX transferred to customer's wallet

- 5. Connect to stablecoin network

- 6. Bank holds USD as collateral

- This maintains 1:1 backing ratio where each USDX is backed by 1 USD in custody.